- Design industry shaping loyalty programs

- Integrate easily and go live quicker

- Deliver hyper-personalized consumer experiences

Accor Plus - The Subscription Loyalty Proposition Leading the Global Hotel Industry in Loyalty TV's latest episode Watch Podcast >

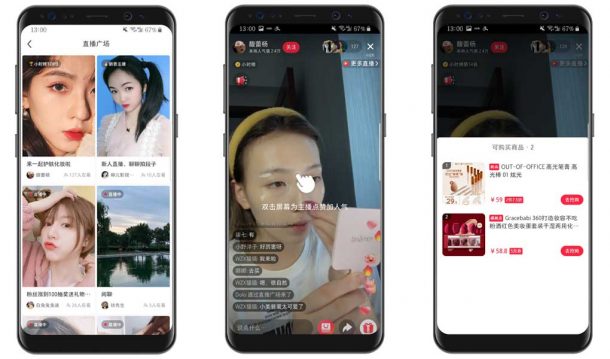

Livestream Commerce in China found its inception in 2016 when Alibaba launched Taobao Live, a platform marrying livestreaming and ecommerce. The company successfully tapped into the massive Chinese consumer market by crafting a powerful overlap of ecommerce, live stream and social media. Soon, users spent more than double the amount of time shopping on livestreaming channels than on the normal Taobao platform (the Chinese equivalent of Amazon).

Since then, live stream marketing has garnered a zeitgeist-like status in China with shopping events like Single’s Day being heavily promoted in the medium and revenues rocketed to $91 billion in 2019.

Unlike its aging counterpart, live stream shopping is a two-way experience and viewers interact both with the presenter as well as with each other. Even complete strangers chat with each other and discuss whether to buy products and how to use/wear them – it’s essentially an ephemeral community that gathers for a brief period of time to connect, interact, purchase, and finally disperse. But there are certain macro factors that spurred the instance growth rate of live commerce in China.

The live streaming commerce scene in China first blew up in 2019, creating a new industry at the intersection of ecommerce and live streaming. The COVID crisis further accelerated the already rapid growth of live stream commerce in the region. As Chinese citizens ended up spending more time indoors, and unable to visit physical stores, several brands adopted live streaming to meet the demands of homebound shoppers.

According to Chongqing Morning Post, in the first half of 2020, the market size of live streaming in China soared up to 456.12 billion yuan, predicted to attain 971.23 billion yuan, compared with 19.64 billion yuan in 2017. The growth rate of live stream commerce in 2020 is about 119%.

According to data from Statista, around half of the total population is connected by social media, and the number of social network users is expected to reach 1.1 billion by 2023.

Gen Z and Millennials consumers make up the majority of both shoppers and hosts, typically ranging from age 20 to 35. This is not a surprise since more than 70% of Chinese Gen Z consumers prefer buying products directly from social media, compared to a global average of 44%. This cohort grew up using social media and are digital natives who are not just comfortable using tech; they see it as part of their daily lives, rather than something innovative and revolutionary.

According to eMarketer, China has the highest rate of ecommerce of any country as a percent of total retail sales (over 35% in 2019), the highest absolute sales level (more than 3 times the U.S. total, the second-largest country), and one of the fastest growth rates of any country, off an already high base. Ecommerce in China is projected to be $1 trillion dollars in 2021, up from $862 billion in 2019.

China is perhaps one of the few places in the world where the concept of ‘Superapp’ found immediate adoption and success. For instance, WeChat’s livestream platform includes integrated ecommerce built into the app itself and also supports diverse other use cases (QR Codes, mobile payments, hotel & flight reservations, etc).

China underwent a rapid transformation from being a rural agrarian and manufacturing economy to a consumer-oriented, service-based juggernaut, leading to mass migration from rural to urban centers. This elevated the loneliness and isolation amongst the urban population. Another contributing factor to the rise of livestreaming is the country’s one-child policy – which led to vast gender imbalance (estimated to be near 70 million more men-to-women) and millions of lonely men’. As a result, millions of partnerless Chinese men with few opportunities for family formation and romance turn to live streaming sessions to interact with women.

While there are several upsides to live stream commerce, there are a couple of disadvantages as well :

The biggest downside is hardcoded into its very nature – it’s live and there are no retakes.

There is a ‘lack of control’ aspect with livestream commerce which brings with it certain risks for brands. However, it’s important to realize that mistakes will happen and viewers are generally forgiving, and most of them expect some bloopers on the live stream platform.

Brands can minimize mistakes by having a handy checklist, ensuring every piece of equipment is double-checked, and doing multiple dry runs before the main event.

Top platforms like Taobao live, Douyin, Kuaishou and Pinduoduo have millions of viewers in China and help brands to acquire users at a fraction of traditional advertising channels.

DouYu is a Twitch-like livestreaming app that was first launched in 2014. It’s the largest game-streaming platform in China and is backed by Tencent. Douyu holds exclusive streaming rights to 29 major tournaments in China and users stream games like DOTA2, League of Legend and Honor of Kings to their audience. With a 160 million MAU, DouYu has now surpassed Amazon Twitch’s 140 million MAU. From a livestream commerce perspective, the platform is favored by gaming-centric brands like Logitech, Alienware and Razer that are looking to target a niche audience.

Tencent’s live streaming platform was first launched in 2014 and boasts of 800 million Daily Active Users (DAUs). The platform has more than 1.3 billion pieces of original content. Kuaishou’s algorithm differs from its peers in that it distributes traffic amongst a diverse segment of videos rather than focussing on the ones with the highest likes (negates the echo chamber effect). Another defining characteristic of Kuaishou is that it is an app for the masses and appeals to people in tier-2 and tier-3 cities.

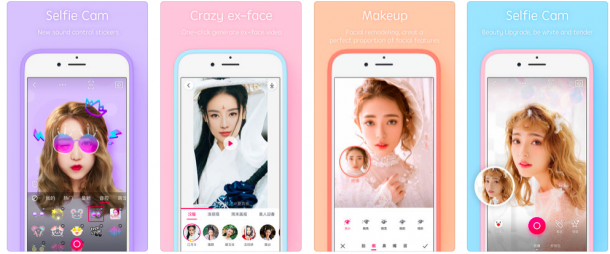

The Chinese avatar of TikTok but enhanced with more sophisticated and mature commerce capabilities. Douyin boasts of more than 600 million daily users who can do much more than simply watch short videos. For instance, users can shop for a featured product, book a hotel, and even become a KOL. Though the percentage of live stream sales is a distant second to Taobao Live, the platform is poised to be the next biggest thing in Chinese ecommerce.

The COVID pandemic further fuelled the livestream shopping frenzy in China. But the billion-dollar question is whether live stream commerce has a global appeal or is it an isolated and localized phenomenon? Well, livestream shopping is still in nascent stages in Europe with brands seeing some traction in France and Russia. In the US, there are several brands and startups that are trying to replicate the livestream commerce success. Amazon has already launched a livestream platform and a slew of startups like Ntwrk, Popshop Live and CommentSold are building a platform for small businesses and retailers. Ultimately, the challenge will be less around building the technical capabilities but more around attracting a critical mass of audiences and influencers.

March 11, 2021 | 4 Min Read

Livestream Commerce in China found its inception in 2016 whe