- Design industry shaping loyalty programs

- Integrate easily and go live quicker

- Deliver hyper-personalized consumer experiences

Blue Rewards from Al Futtaim Group Shares Loyalty Success Stories and Evolution. Watch Podcast >

Capillary Announces 2nd Annual Captivate 2025 Summit: Transforming Loyalty Management with New AI Tech Read more >

64% of the world’s oil reserves come from the Middle Eastern region! Ironically, when it comes to the forecourts businesses, each GCC country has a different pace. While UAE and Qatar are at par with US and European fuel stations, Saudi Arabia is lagging behind. This is especially unbelievable given that Saudi Arabia has the largest reserves in the GCC countries with more than 260 billion barrels.

This is owing to the change in Saudi Arabian consumer trends, as the kingdom has recently changed their laws allowing female drivers, and with large players like ADNOC and Saudi Aramco come into the foray. On the other hand, UAE and Qatar have more advanced fuel forecourts due to their consumers’ love for automobiles.

But, petrol stations have and will become more than just a place to fuel up cars. They would become centers of wider retail offerings, personal services, delivery pick-up points, and much more. Amid this evolution, loyalty programs have become an important part of this brand new fuel experience. Keeping in mind that the fuel brands need to build their loyalty strategies based on consumer expectations and needs, let’s look at some of the trends and how brands can incorporate them in loyalty programs.

1. Mobile apps

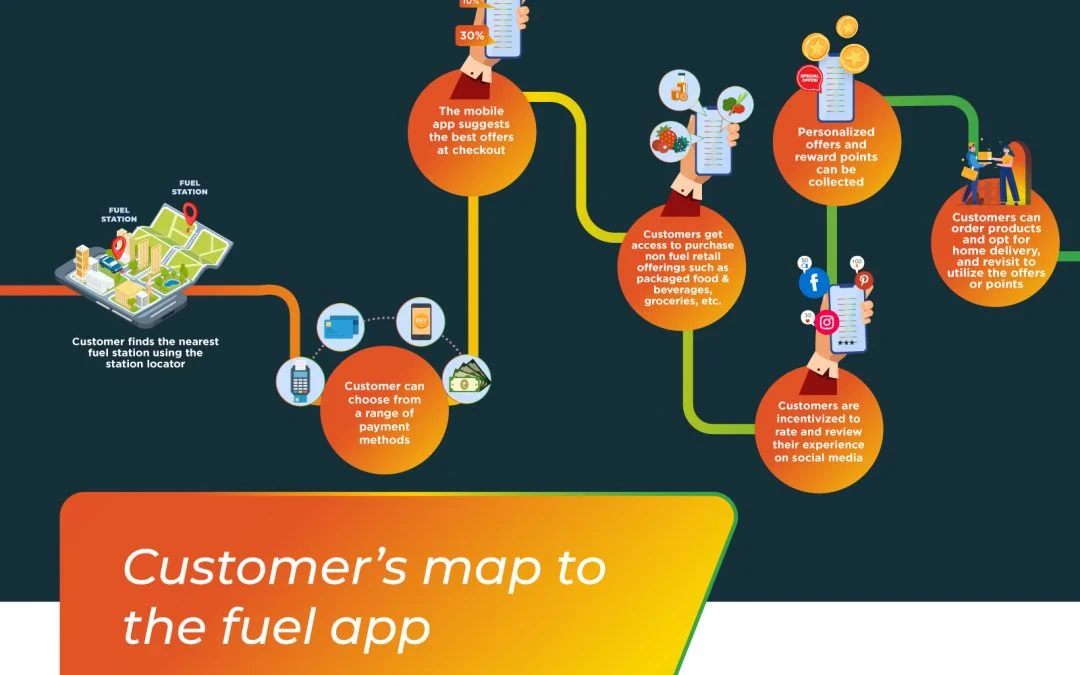

In this age, fuel retailers can digitize the entire customer journey via mobile app. With a single sign-up, customers can find the nearest station with the geolocator, use a variety of digital payment options, explore multiple discount offers, access the ancillary stores and services, rate the experience and finally win points and rewards for the transactions. Setting up a fuel loyalty app is essential, as brands can reach out to the 174 million Middle Eastern mobile users, who are gradually warming up to digital payments and mobile wallets.

2. EV and sustainability

The global buzz on electronic vehicles and hope for a sustainable future has spread to the Middle East too. It may seem counterintuitive that consumers from oil-rich countries are moving towards EV, but there is an increasing need for this shift in a world where resources are waning and pollution is increasing. While Middle Eastern governments have already started their search for alternative fuels, brands must also participate in this change. Apart from establishing charging stations for EVs, they can also promise a clean forecourt with proper recycling, constructing stations with environmental-friendly material to create a transparent platform via mobile app to interact with customers about sustainability.

Conversations about the future are particularly important at a time when countries are planning towards net zero carbon emissions based on the Paris Climate Agreement and global discussions at the COP26 summit.

3. Non-Fuel Retail Category

Imagine your customer is off on a long trip. At some point along the way, they are bound to stop for refreshments and refill their vehicle’s fuel at one place. This is not a new concept for fuel brands to partner with QSR joints or convenient stores. However, relevant offers can closely tie the two products together and create more customer touchpoints. For example, a customer can get discounts on certain packaged foods based on fuel transactions and vice versa.

With the boom of the electric vehicles market, fuel retailers need to diversify into providing innovative non-fuel offerings and services. In a recent survey by Deloitte, around 60% of the respondents said that they buy food, groceries, fast-food meals and other non-food items apart from filling petrol at a forecourt. In terms of ancillary services, fuel retailers can offer a variety of vehicle-related checkups and cleaning, act as a pick-up point for deliveries, laundry services, bill payments and so on.

4. Fuel delivery

Contactless experiences have taken center stage since the COVID-19 pandemic. In this light, home deliveries have been extremely prominent in all sectors, and recently, the trend has hit fuel retail as well. This service is especially helpful when the customer finds their tank empty and would need petrol in an emergency situation. Several players especially in the UAE have revolutionized this trend. Apart from fuel, food, beverages and other grocery items can also be delivered. Retailers can easily integrate these services within their app to offer a seamless experience to customers.

5. Data-driven marketing

Reports suggest that customers from the Middle East are far more open to sharing data, knowing that it would lead to hyper-personalized offers and experiences. Therefore, fuel retailers may want to focus on capturing this data, creating a comprehensive view of the customer to understand their needs and reward them accordingly. Brands can then administer discounts and rewards on frequently purchased items and nudge customers to try new products or services, through notifications when they typically visit the fuel station.

The future of fuel retail is closely linked to the future of transport, and in this regard, all roads lead to electric vehicles. In fact, transitioning to sustainable mobility could unlock a $400 billion opportunity for GCC countries in the next 2 decades. While Middle Eastern fuel retailers currently enjoy the high ratio of private vehicles at 91%, consumers could gradually move to EVs and shared mobility. Therefore, brands need to be prepared to reshape their forecourts with non-fuel offerings.

Get in touch with our experts to find out more about how your fuel brand can stay future-ready and improve your customer retention.

January 10, 2025 | 6 Min Read

Fuel loyalty programs are evolving fast. Discover the latest

November 29, 2021 | 4 Min Read

Globally, the evolution in the Fuel, Oil and Gas industry ha

November 12, 2021 | 4 Min Read

The challenging dynamics created by COVID-19, has destabiliz