- Design industry shaping loyalty programs

- Integrate easily and go live quicker

- Deliver hyper-personalized consumer experiences

Blue Rewards from Al Futtaim Group Shares Loyalty Success Stories and Evolution. Watch Podcast >

Capillary Announces 2nd Annual Captivate 2025 Summit: Transforming Loyalty Management with New AI Tech Read more >

Oil and Gas Retail companies face unique challenges when it comes to fuel retail loyalty programs. Fuel prices are not only highly regulated but also fluctuate with global crude oil trends, making profit margins on fuel sales slimmer than in other sectors. Interestingly, fuel retailers often see profitability decrease as prices rise and improve when prices fall due to volatility in wholesale gasoline prices and market competitiveness (as noted by the Association For Convenience & Fuel Retailing). In such a dynamic environment, loyalty programs are essential for building lasting customer relationships and ensuring repeat visits.

A well-structured fuel loyalty program in 2025 should focus on personalized rewards, seamless digital experiences, and data-driven engagement. Whether it’s integrating mobile payments, offering fuel rewards card benefits, or crafting tailored promotions, success lies in understanding what drives repeat visits. In this blog, we’ll explore the best fuel loyalty programs, their impact on customer retention, and how to design a strategy that maximizes engagement.

In 2025, green loyalty is increasingly becoming an important factor for the modern day consumer. Fuel retailers are challenged by consumers’ growing concerns of the impact of fuel consumption on the environment and climate change across the world, and unfortunately, fuel-guzzling vehicles are viewed as a step in the opposite direction of progress. Recently, BP (formerly The British Petroleum Company) announced a new purpose: “to reimagine energy for people and the planet” which is supported by a new ambition to be a net-zero company by 2050 or sooner.

BP isn’t the only brand coming to terms with the world’s diminishing carbon budget. Shell, one of the largest multinational Oil and Gas companies, is reinventing itself as an international energy company that aims to meet the world’s growing need for cleaner energy solutions, in ways that are economically, environmentally and socially responsible.

Customers today crave personalized, convenient, and emotion-fueled (pun intended) experiences, and fuel retail brands that haven’t differentiated themselves in these aspects will find customers returning only for consistently low prices which is not a great revenue strategy in the long term.

So how can fuel retail loyalty future-proof business during unpredictable times?

Firstly, brands must drive non-fuel retail sales from in-store food, beverages and more, and drive additional vehicle services, all of which can yield a much higher profit margin than fuel sales. For instance, on an average day, Shell serves customers on nine different shopping missions, seven of which are not associated with fuels.

Secondly, if we are to take examples from leading brands like Shell and BP, fuel brands must have one finger on the consumer’s pulse, and make business decisions that keep in line with expectations.

We believe that a personalized customer engagement strategy can give an enormous boost to fuel retail loyalty programs. Here are some key strategies and insights on how fuel and oil companies can implement a consumer-centric, future-proof loyalty program.

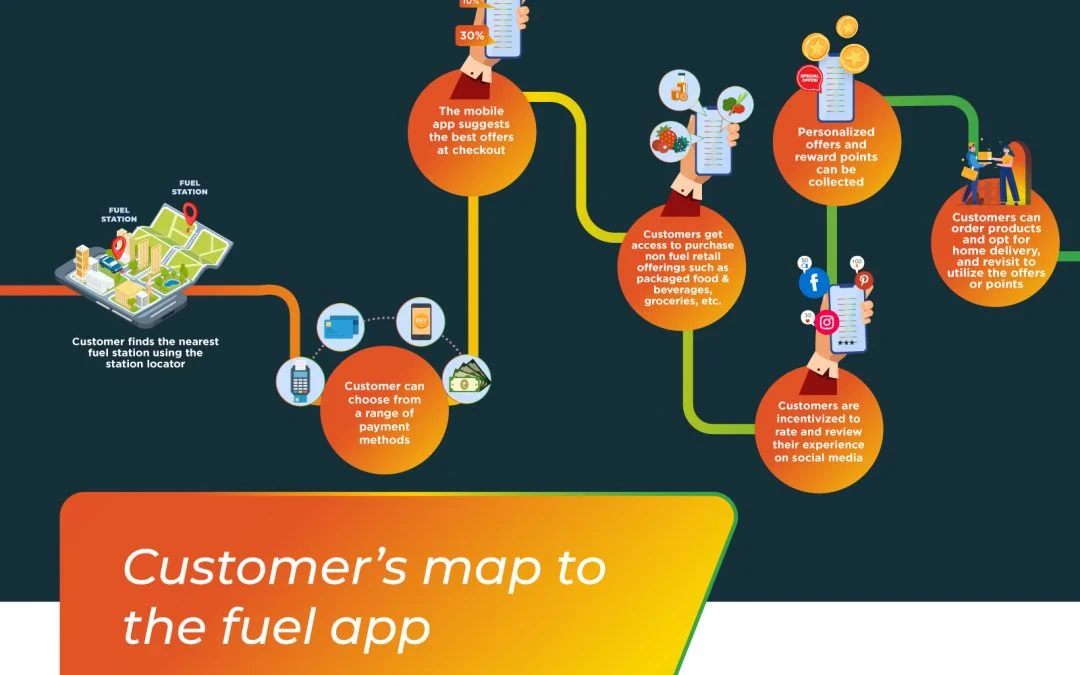

Fuel stations are frequented by a diverse segment of customers, from time-crunched businessmen to unhurried grandpas. Keeping your loyalty program attractive to these diverse personas of customers is key to the success of your program. An omnichannel loyalty program allows you to do that. These programs facilitate an omnichannel engagement strategy by unifying customer data across multiple channels and building a 360-degree view of the customer.

However engagement is only one part of your omnichannel strategy, the other is accessibility. By enabling digital cards and social media integrations, your loyalty program is always available from the mobile app. Learn more about how Mobile Apps Are Redefining Fuel Retail Loyalty.

Implement loyalty elements that go beyond simple discounts or points that blanket-target all customers. By understanding the psychology of various customer segments, fuel retail brands can analyze customer behavior, and segment them based on their individual preferences, interests and missions, and finally reward them highly personalized, experiential rewards.

For this, it’s vital for brands to identify and understand customer mission and purchase patterns. Is the visiting customer an individual user, or part of a fleet service? Is he a high-frequency customer or a sporadic one? Will they be more inclined towards a free beverage as a reward or discounts on future refuels.

Rewards and engagement must be customized based on the desired behaviors from different customer segments, engagement varying with their location, age group, life-events (birthdays, anniversaries), and more.

With on-the-go drivers sensitive to staying on schedule, the key to delighting customers is providing services that are timely. This can be accomplished by a fast, streamlined and convenient transaction and refueling experience.

The ideal time taken for refueling a vehicle should not be more than 3 minutes. Digital technologies such as cashless payments help reduce valuable customer time while increasing transaction security and are already in steady use across the world.

Repsol Mas (a Spanish fuel retail brand) offers a digital wallet and universal payment app that lets consumers pay by phone, earn points and save during transactions.

Contactless transactions are only increasing in popularity throughout the world. Fuel brands must introduce QR code scanning for payments, or prepaid wallets linked to their mobile app, both of which will save drivers valuable time.

Fuel Retail brands like China National Petroleum Corporation (CNPC) have enabled “smart fueling stations” which enables customers to fuel their vehicles without stepping out. CNPC claims that smart fueling has cut down fueling time from six minutes to approximately two minutes.

Fuel retail brands can further reduce customer time by enabling pre-booking services or meals through their mobile phone app.

A Fleet Loyalty Program is a card management system through which a fuel retail brand offers a credit line and rewards for businesses with a fleet of vehicles. As an example, consider a cab service company leveraging a fleet loyalty program from a specific fuel retail brand. Not only does the program provide a convenient, quick mode of payment for fuel purchases for all drivers belonging to the cab service company, it also assures a steady stream of business for the fuel retail brand.

While the program offers the cab service business fuel on credit by using the cards, it also rewards the loyal customers (either individual drivers or the business itself) for their spending.

Based on advanced geolocation and beacons, fuel retail brands can trigger personalized offers to make people aware of fuel stations and stores near them. This is a great way to beat competing brands in a specific service area with a proactive approach, which can help shift customer behavior in your favor. However, brands must take care to not trigger communication intrusively as that will be a quick way to losing customers.

An alternative to the proactive approach is to enable customers to find the right offers and stores through your app when they require it.

Exxonmobil has enabled a Speedpass+ loyalty app that also allows customers to search for nearby Exxon and Mobil stations, and pay for gas right from their phones through Samsung Pay, Apple Pay, and other methods.

As fuel retail loyalty programs continue to evolve, brands that prioritize customer engagement, personalized rewards, and seamless digital experiences will stay ahead. A fuel rewards card with tailored perks, real-time discounts, and cross-brand partnerships can make a significant difference in customer retention and spending behavior.

By leveraging the latest loyalty trends for 2025, fuel retailers can transform one-time customers into loyal advocates. The key is to keep the program simple, rewarding, and customer-centric because in an industry driven by choice, the brands that offer true value will always win. Talk with our experts today, and take your fuel retail loyalty program to the next level!

November 12, 2021 | 4 Min Read

The challenging dynamics created by COVID-19, has destabiliz

February 4, 2025 | 4 Min Read

Fuel retail is evolving, with Mobility-as-a-Service (MaaS) r

December 7, 2021 | 4 Min Read

64% of the world’s oil reserves come from the Middle Easte