- Design industry shaping loyalty programs

- Integrate easily and go live quicker

- Deliver hyper-personalized consumer experiences

Blue Rewards from Al Futtaim Group Shares Loyalty Success Stories and Evolution. Watch Podcast >

Capillary Announces 2nd Annual Captivate 2025 Summit: Transforming Loyalty Management with New AI Tech Read more >

Globally, the evolution in the Fuel, Oil and Gas industry has begun. Marketers have adapted their brand and business strategies to the shifting fuel retail paradigm between drivers and forecourts.

Accelerating this change, the non-fuel retail business took the lead this year exhibiting potential in QSR, drive-through services, additional car care services, last-mile delivery, etc. Of course, the fuel sales dropped by 50 percent during 2020 but the fact that it recovered its ground soon was a welcoming sign for many fuel brands. While the tumultuous journey was a lesson learnt the hard way, new explorations were simultaneously made in the fuel retail business. As we bid goodbye to this year, let’s review the year that has been for the fuel retail sector and what charged the marketers to stay ahead in their game. Here are 5 top fuel retail trends that soared high globally in 2021 and are all set to continue from here.

By far, this is the biggest bet that many fuel brands are placing on their business and marketing strategies. It has been established post COVID-19 pandemic that forecourts are no longer seen as fuel-only stations. Fuel retailers must view them as convenience stores that sell fuel and other fuel related products. In fact, to avoid crowding supermarkets in malls during 2020, many people moved to stand-alone convenience stores like the ones at fuel stations to shop for their daily needs to practice social distancing.

Fuel retailers may try to outshine competitors by fabricating a good ambience at pumps with comfortable seating, parking lots, electric vehicle charging points, convenience stores offering a gamut of products, to modernize customer engagement. A recent study by KPMG on forecourts experience tells, ‘The total market size of the forecourts is predicted to reach $274 billion by 2029.’ It could thus be stated that fuel stations that would not include Non Fuel Retail goods might have to face a stiff competition in the market.

Government implications and early adopters had already set the stage for renewed mobility options. In one of our fuel retail blogs, we had also spoken about how aggressively companies and economies need to meet the targets set by the Paris Agreement. Stringent reforms on emissions, preference to alternative fuels like that support a sustainable environment has enabled a new era of electronic mobility across the globe. Even the advent of newer fuels (like LPG, Bio and Hydrocarbon Fuels) in some countries was a table turner for this sector that proved its valiance post pandemic. In fact the overall spike in the sales of battery-operated vehicles and plug-in hybrid electric vehicles in 2020 is a testament to the forthcoming change. Its full adoption in comparison to the conventional mode of transport, however, is still a questionable argument. Many global fuel brands are also providing premium fuel with additives to reduce emissions and increase engine efficiency, in order to move towards customization of offerings and personalization of experience, and yet targeting fuel loyalty.

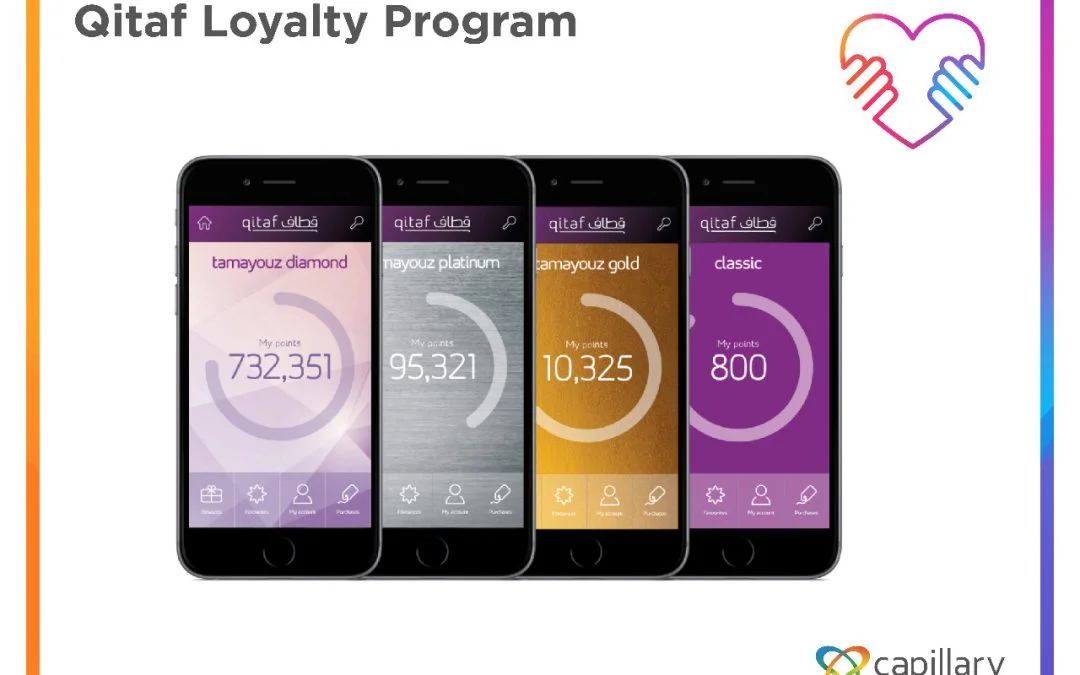

Data in silos has done no good to any brand. Fuel retail is not an exception too. A single step in the digitized direction can help brands open new avenues. Moving from a card-based loyalty program to a digital mobile app is not only a convenient feature for a customer but it is also a credible piece of customer information from a brand’s perspective. The ease of digitized app is far superior than carrying a physical card. Eventually, digitization would also create a shift in consumer’s perception about mobility. The growing popularity of MaaS or Mobility-as-a-Service in a few nations is also driving the world with renewed mobility options. This broader ecosystem includes ride sharing, ride hailing, a one way or a two way vehicle sharing options allowing users to move from asset ownership to shared mobility services. Digitization could be a big enabler in helping consumers and retailers to adapt to this new trend.

Burgeoning consumer trends that have come forth owing to the changing lifestyles and technological advancements post pandemic are here to stay. This has enabled fuel brands to think from a convenience standpoint. The all-in-one fuel app allows consumers to not just transact and keep a tab on their vehicle’s fuel intake but has become a mandate in a contact-less world with digital payments taking the front seat. Enabling a digitized customer journey, tracking customer data to study customer needs and behavior is a pedestal to design targeted CRM campaigns. This also helps marketers and retailers focus on more up-sell and cross sell opportunities through the App. Another convenience-centric trend is the pick-up and delivery option that enables people to save on time while they fuel up their vehicle tank. This ecommerce enabled functionality is touted to come in a big way focusing on stations located at the nearest points. In the Middle East for instance, a popular fuel brand offers fuel delivery option. This could be a major game-changer especially for consumers caught up in the SOS situation.

Fuel retailers are moving into convenience and alternative retail offerings to diversify their revenue streams. Collecting the right data set and drawing meaningful insights about consumer buying preferences and behavior from it, will help upgrade the customer engagement. This data can be utilized to drive constant improvement of the loyalty program and its offerings like more customized encounters, products, services, and benefits to the consumers. Customer needs are prioritized.

Although each fuel retailer could implement similar strategies, creating differentiation in this industry is a challenge. Hence fuel retailers are considering other value-added services like opting for consumer-centric loyalty programs to create a quantifiable difference. Value proposition is at the core to encourage loyalty and build brand affinity, especially in an undifferentiated product category like this. A highly motivating value-proposition will enhance consumer involvement. The value-proposition for the loyalty program should be distinctive and easy to understand for the customers. This can be enhanced by providing incentives to consumers such as personalized rewards, providing additional loyalty points which could be easily redeemed, occasional rewards like birthday wishes to make customers feel special, periodic and seasonal offers, etc. Geo-location-based rewards can be provided at nearest petrol pumps so that customers stay loyal to a fuel brand.

A well-crafted fuel loyalty program could thus prove to be a strong tool to increase brand affinity, engage customers, be on top of the mind recall and reduce customer churn. Interacting with customers at multiple touch points increases hyper-personalization and builds customer engagement. A portion of your fuel retail loyalty program configuration should be a communication strategy that guides out when and how you will communicate with your consumers. Our team of fuel retail loyalty experts have closely reviewed the market trends to create loyalty marketing strategies for some of the leading global fuel brands. Get in touch with them and drive your fuel brand sales and revenue.

March 4, 2022 | 4 Min Read

The recent e-commerce boom ushered in a brand new era for cu

December 4, 2024 | 6 Min Read

From a basic earn-and-burn model to physical loyalty cards,

December 22, 2024 | 4 Min Read

Moving over earn and burn, personalization has now become hy