- Design industry shaping loyalty programs

- Integrate easily and go live quicker

- Deliver hyper-personalized consumer experiences

Blue Rewards from Al Futtaim Group Shares Loyalty Success Stories and Evolution. Watch Podcast >

Capillary Announces 2nd Annual Captivate 2025 Summit: Transforming Loyalty Management with New AI Tech Read more >

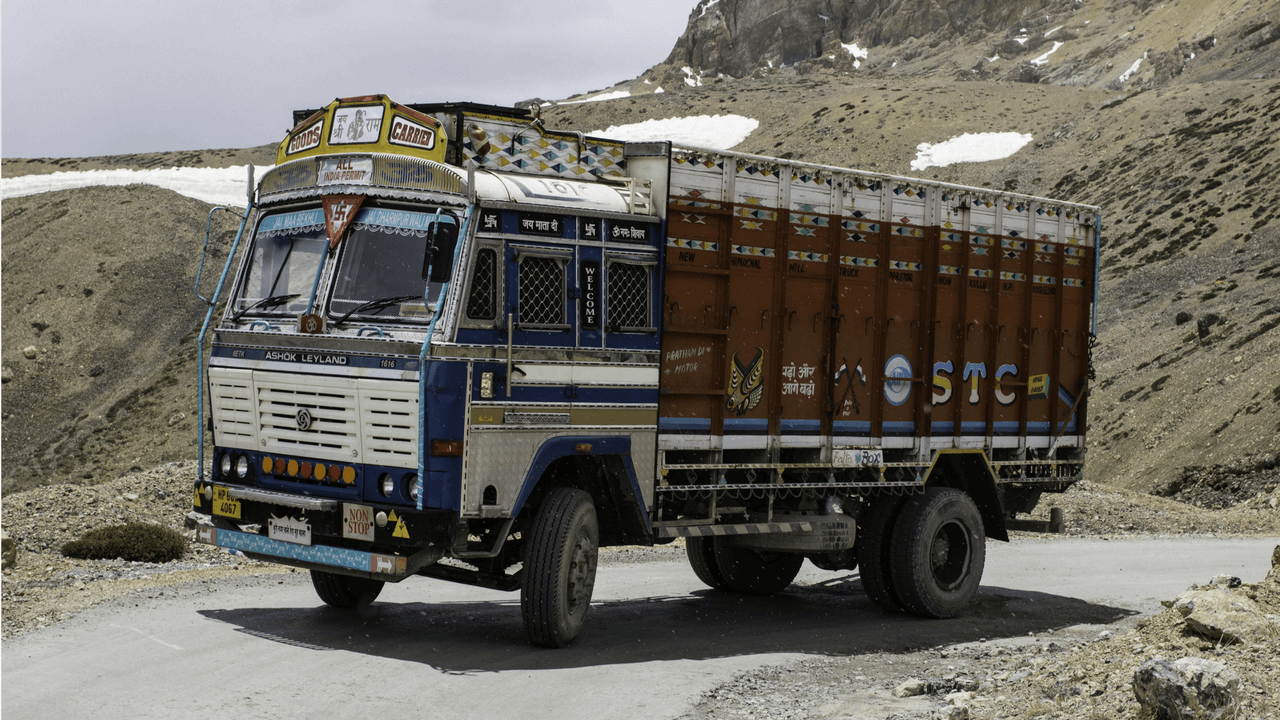

Indian Consumer Goods/FMCG distribution has always been a dynamic and complex affair due to multiple tiers in the structure with Carrying and Forwarding Agents, Dealer/Distributors, Wholesalers and the end Retailers spread across the entire country with different states/geographies having unique characteristics. The top FMCG brands hence have always been using Reach and Coverage as the two prime levers to increase share. The recent developments like GST along with the rapid proliferation of cost effective telephony (4G, Jio) have created opportunities for brands to streamline their distribution network and increase reach in an efficient manner to win in the market place. Companies are trying to reach the Kirana Shop Retailers directly to the extent possible to influence sales instead of relying on wholesale distributors and other tiers in the network.

Multiple experiments and pilots are being conducted in the Indian and South East Asian Market place by FMCG companies and similar Consumer brands to interact with the retailers more optimally and increase uplift. The common assumption in most of these pilots is that most Indian Kirana Shop owners are time-starved and do not have more than a few minutes to talk to the sales representative of an FMCG Major, being more concerned about serving customers and sending them out of their shop happily.

The first set of pilots that have been attempted are getting the Bigger Retailers (Large Kirana Shops who do more than 8 Lacs INR turnover a month) to order directly using a mobile App from the Distributor. This enables the Consumer Brands to directly track sales, they can understand off take , convey promotions and also using a bit of analytics and Machine Learning, uncover additional insights such as ‘Retailers at Risk’ , SKUs that are not doing well in the short term, top 5 items that a sales person should try selling to the shop and so on. Already one of the world’s largest retailer is successfully enabling 25 % of its India sales by this B2B app based ordering model.

However the challenge in scaling up of this model is the point mentioned earlier – the average kirana shop owner being time starved will not want to use different mobile apps for multiple brands as he would be stocking at an average of 50-100 different brands in his shop. There are two ways this challenge could be handled and both are being attempted by Innovators in the market place. The first is by small companies that serve as a consolidator of all the brands and then deliver to the retailers. They take care of the ordering and logistics as well. This sounds fine in theory but scaling up has significant challenges and one does not see this covering more than a few hundred retailers in a handful of metros in a few years’ time.

The other model, attempted by a few software solution providers, starts off with insights driven, AI and ML based ordering platforms. These are used by an FMCG brand’s distributor sales force who assist with ordering of a few top brands for the retailers and slowly scaling up to the entire or a reasonable chunk of the ecosystem. This model seems to have more chances of succeeding.

There have also been attempts by companies to provide intelligent Point of Sale (POS) machines at the kirana shop end to get instant visibility of tertiary sales, thereby giving a superior ability to forecast, assess promotion attempt and stock levels. But these have usually been dropped either on account of costs or the practical difficulties in forming a consortium of non-competing manufacturers as well as practical difficulties in establishing an eco-system to support such an initiative.

In summary, while all these experiments are on, one inference is possibly agreed by all. The ordering mechanism or the technology aspect is sort of taken as a given, it is possible, the challenge is in making the mechanism worthwhile to the retailer and sticky. FMCG companies are realizing that this is better achieved by having a retail data analytics platform built on AI and Machine Learning that can provide instant actionable insights to the sales leadership as well as the feet on the ground to effectively push sales across channels. These can be in the form of personalization – identifying the right category / SKU/Promotion to be pushed in the right channel/retailer, Complex Trend Analytics – using Machine Learning to isolate and identify granular trends from complex sales signals and generate alerts and actions instantly when the salesperson is at the retail shop and tracking SKU, product performance and projections at a granular level. FMCG companies need the analytical power to actively orchestrate and drive the sales execution in the field instead of doing a lot of Post Facto analytics. There is no silver bullet amongst all the options described to achieve this but the one who stays agile, nimble and constantly learns and unlearns will be the one that wins the highly promising Indian Consumer Industries Marketplace.

Capillary , given its long and rich history in helping retailers in the developing world to reach closer to their consumers , is poised well with its solutions and innovations to help FMG brands reach and effectively engage with their customers ( Retailers) and end consumers through digitization, and actionable Insights powered by retail analytics, AI and ML. The ready to deploy Direct To Retailer (D2R) platform and app is a culmination of these trends. Capillary B2B Commerce & Direct to Retail (D2R) solution can enable brands reach directly to the retailers via their distributors while understanding and maximizing their business.

Transform your Indian FMCG brand with digital distribution. Request a demo of Capillary’s digital distribution solution.

August 1, 2023 | 4 Min Read

Generative loyalty uses predictive analytics to drive intell

March 26, 2024 | 4 Min Read

Explore Clarissa Schealer's insights on leveraging AI for pe

January 13, 2024 | 4 Min Read

Predicting customer behavior is critical to improving custom