A PaymentsJournal article sheds light on some intriguing numbers related to Fraud and Loyalty Programs:

- There are over $140 billion in unspent loyalty points in the United States alone

- $3.1 billion in redeemed points are fraudulent

- Direct and indirect losses from loyalty and reward points fraud are an estimated $1 billion

These numbers clearly suggest the magnitude of fraud in loyalty programs and why it can be a cause for concern. As a marketer, fraud in loyalty programs may not be a mission-critical element to running successful campaigns but increasingly, it has become an area that cannot be ignored.

What is a Loyalty Fraud?

When a customer or a fraudster misuses loyalty points through some tactic or hacks into a system to redeem points, such fraud is termed Loyalty Fraud. There are several ways in which loyalty fraud can happen- sometimes a brand’s employees may be involved, sometimes it can be a hacker who hacks into a system of customer data, and sometimes it can be a group of people colluding to misuse loyalty points.

To give a simple example, consider a situation where a cashier punches his/her own phone number in place of the customer’s and gets possession of the customer’s loyalty points. Apart from this, there are several online forums dedicated to teaching tricks on how to find loopholes in a brand’s loyalty program and take advantage.

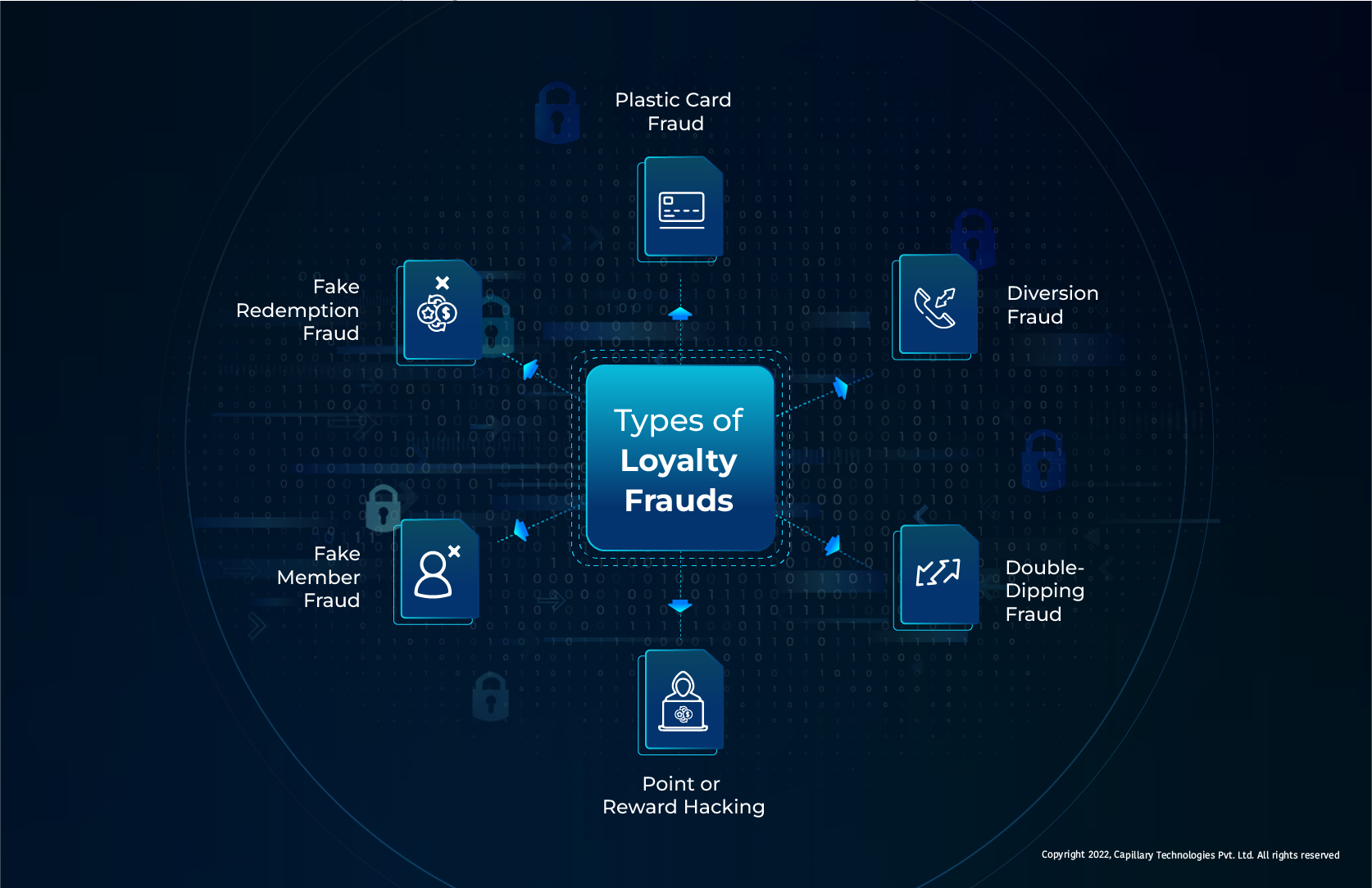

Types of Loyalty Frauds

There are functional frauds and there are technical loopholes. Loyalty fraud can be classified in the following:

- Plastic Card Fraud: This type of fraud involves the fraudulent use of stolen or counterfeit payment cards to purchase goods or services.

- Diversion Fraud: This type of fraud occurs when an employee diverts loyalty points to their own account.

- Double-Dipping Fraud: This type of fraud occurs when a customer registers for the same loyalty program multiple times and earns points or rewards from the same purchase.

- Point or Reward Hacking: This type of fraud involves the unauthorized use of loyalty points or rewards to purchase goods or services.

- Fake Member Fraud: This type of fraud occurs when an unauthorized person creates a loyalty program account and earns rewards.

- Fake Redemption Fraud: This type of fraud occurs when an unauthorized person redeems loyalty points or rewards for goods or services.

Fraud Detection and Fraud Prevention

When it comes to reducing the impact of fraud, there are two aspects to look at – detection and prevention.

Fraud detection in loyalty programs is the process of identifying, analyzing, and mitigating fraudulent activity within loyalty programs. It is designed to detect, prevent and respond to any attempts to misuse a loyalty program or earn rewards through fraudulent means. This involves analyzing and monitoring data points such as customer profiles, transaction history, redemption trends, and other behavior patterns to identify suspicious activity.

Fraud prevention in loyalty programs is the process of protecting customer accounts and data from fraudulent activities. This can include measures such as customer identity verification, monitoring customer accounts for suspicious activity, using customer data to identify potential fraud attempts, and using encryption to secure customer data. Fraud prevention in loyalty programs helps to reduce the risk of customer data being stolen or manipulated and helps to protect customer loyalty and trust.

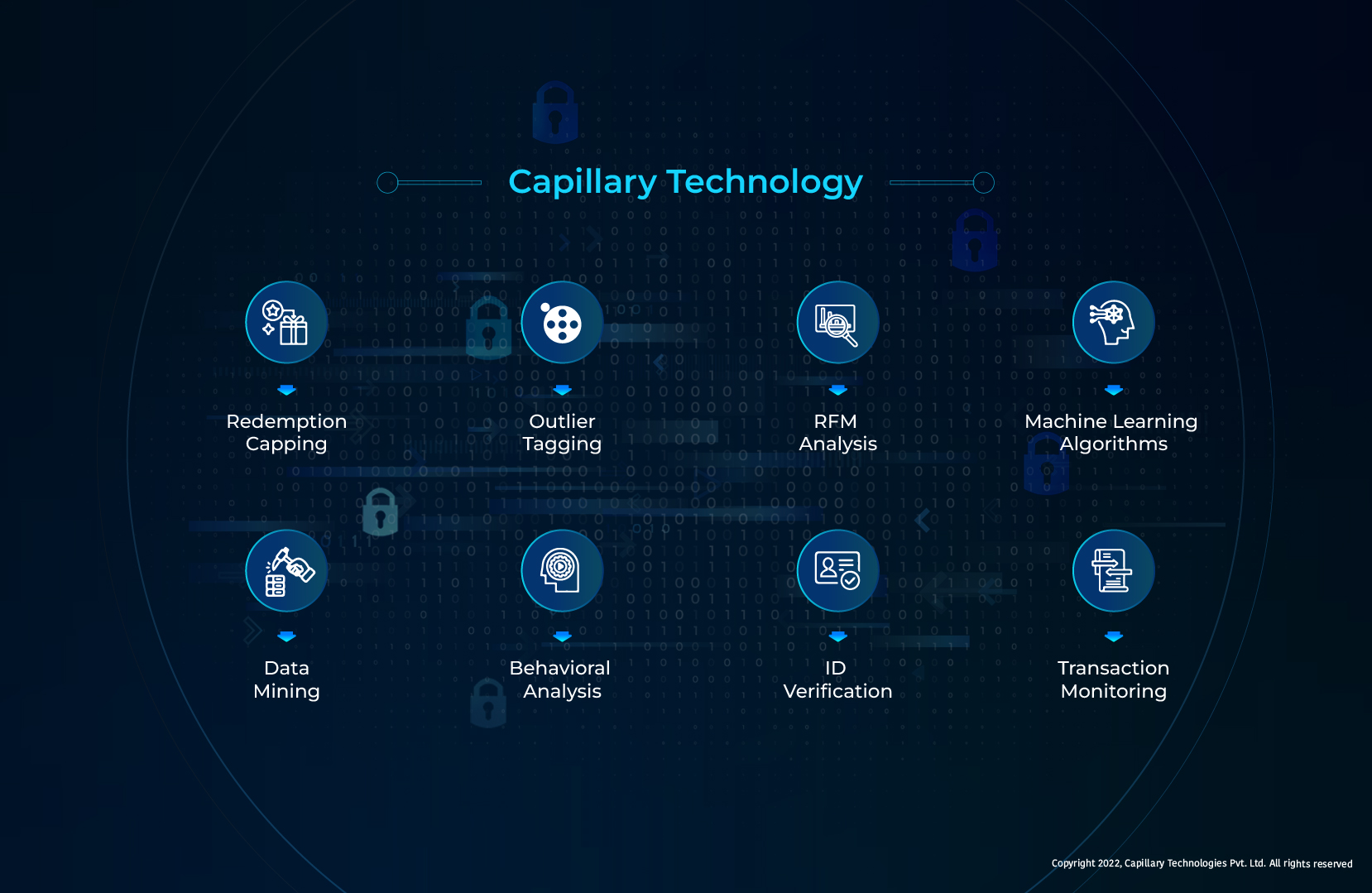

Capillary Technology to Prevent Loyalty Fraud

At Capillary, we’ve worked with 250+ enterprise brands across industries which have led us to build several frameworks which can help brands to detect and prevent loyalty fraud.

- Redemption Capping: Fraud detection is all about pattern analysis. One of the simplest frameworks is around capping the number of points that can be redeemed in one go or capping the frequency of redemption. The Capillary system can help you make rules for the rate of redemption, the number of transactions per week, etc.

- Outlier Tagging: On the basis of business semantics, a brand can define the upper and lower limit of certain data points. For instance, consider a retail brand that has an average ticket size of $25. From historical data, the minimum (say $1) and maximum (say $100) can be set and any transaction which is out of range would be flagged as an outlier and sent for review to the operations team.

- RFM Analysis: RFM stands for Recency, Frequency, and Monetary. Recency is the time elapsed since the last purchase, frequency is the number of transactions in a particular time period, and monetary measures the value of purchases by a customer. The Capillary platform uses this methodology to detect fraud and help brands runs secured loyalty programs.

- ML Algorithms: Machine learning algorithms can be used to detect fraudulent loyalty program activity. These algorithms can identify patterns in customer data that are indicative of fraudulent behavior.

- Data Mining: Data mining techniques can be employed to uncover fraudulent loyalty program activity. The Capillary platform can help uncover hidden relationships between customer data and fraudulent behavior, enabling brands to better identify and take action against potential fraudsters.

- Behavioral Analysis: This can provide insight into customer behavior, allowing companies to identify and address potential fraud. Capillary Nudges loyalty marketers to recognize frauds through these techniques and improve loyalty program efficiency.

- ID Verification: ID verification technologies can be used to authenticate customer identities, ensuring that customers are who they say they are. This can help prevent fraudulent loyalty program activity and protect customer data.

- Transaction Monitoring: Companies can use transaction monitoring technologies to detect suspicious transactions. Transaction monitoring can help identify fraudulent transactions, allowing companies to take action to prevent further losses.

A trusted platform for running bulletproof loyalty programs

Our loyalty experts work with brands across the globe to ensure they achieve the maximum from our loyalty software. Fraud detection is becoming increasingly important in discussions and stringent measures need to be in place to ensure you get the most from your programs.