*Note: This article was first published on March 30, 2020, and it has been updated on May 19, 2020

Predicting the Road to Recovery: Key Findings & Insights for Retailers on tackling the impact of Covid-19 *across China, Singapore, India and the Middle East

Roughly 50 days later after the initial lockdown, China has successfully stunted the spread of the virus, and the country is not only witnessing the recovery of economic fundamentals but showing signs of upward momentum.

China’s economic scale, strong resilience, digital penetration and flexible macro policies are among the major factors which led to the rapid recovery. We believe there are some important lessons to be learned from China on how to successfully deal with this epidemic and chart out a road to recovery in the coming months.

Our position as a leading omnichannel retail solutions provider for more than 400 retail brands in China, India, SEA and the Middle East has offered us a ringside view of how the epidemic unfolded. We collated data for 50+ brands across 10,000 stores in these three regions to understand the impact on retailers, the timeline as it unfolded and measures that can be taken to minimize the negative impacts of the epidemic.

We are happy to share with you these insights as you go about strategizing and planning your road to recovery during this crisis

TL-DR: In this article, we have tracked and analysed :

- Covid-19’s category-wise impact on China’s retail sector

- Key findings and insights on Covid-19’s impact in China before, during and after the lockdown period in Wuhan

- Key findings and insights on Covid-19’s impact in Singapore before and after the Dorscon Orange Alert + expected recovery timeline for Singapore’s retailers

- Key findings and insights on Covid-19’s impact in India + expected recovery timeline for India’s retailers

- Key findings and insights on Covid-19’s impact in the Middle East after the nationwide lockdown + expected recovery timeline for retailers

- Recommendations on charting a road to recovery for retailers

Covid-19’s Impact on China Retail

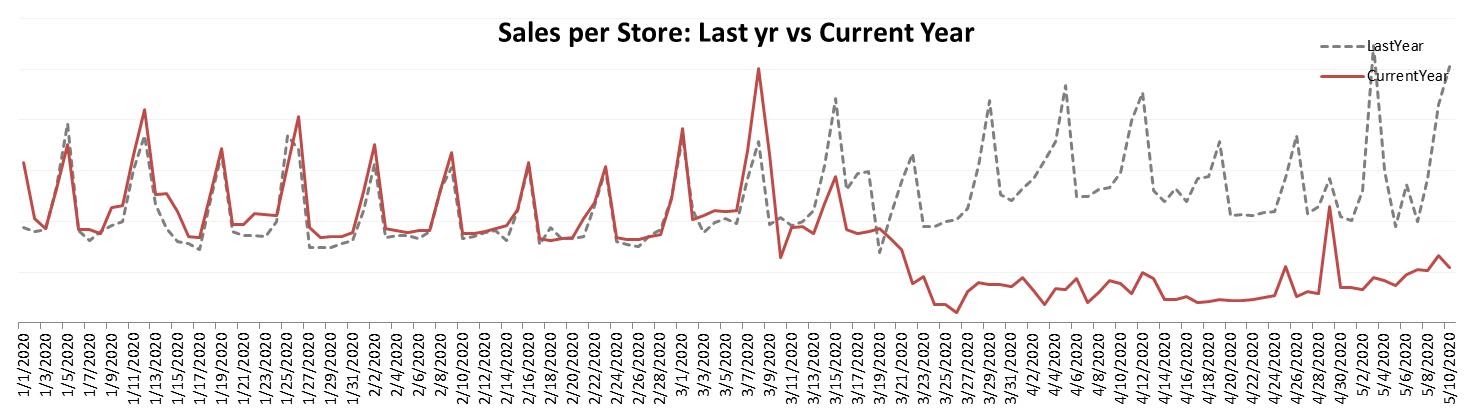

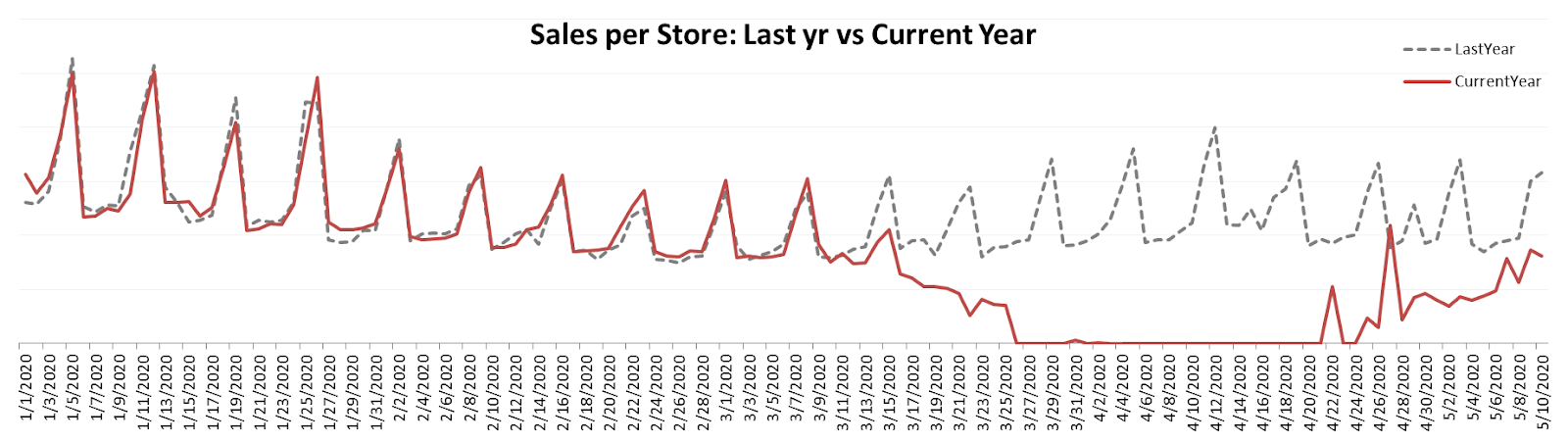

Recovery Period: 6th March 2020 to 15th March 2020

Overall, the epidemic has had a large short-term impact on the Chinese consumer market, and retail sales of goods have fallen sharply. From January to February, the total retail sales of consumer goods fell by 20.5% (YOY) while the retail sales of automobile and petroleum goods fell by 37% and 26.2% respectively; catering revenues fell sharply by 43.1%, and room revenue of accommodation businesses fell by nearly 50%.

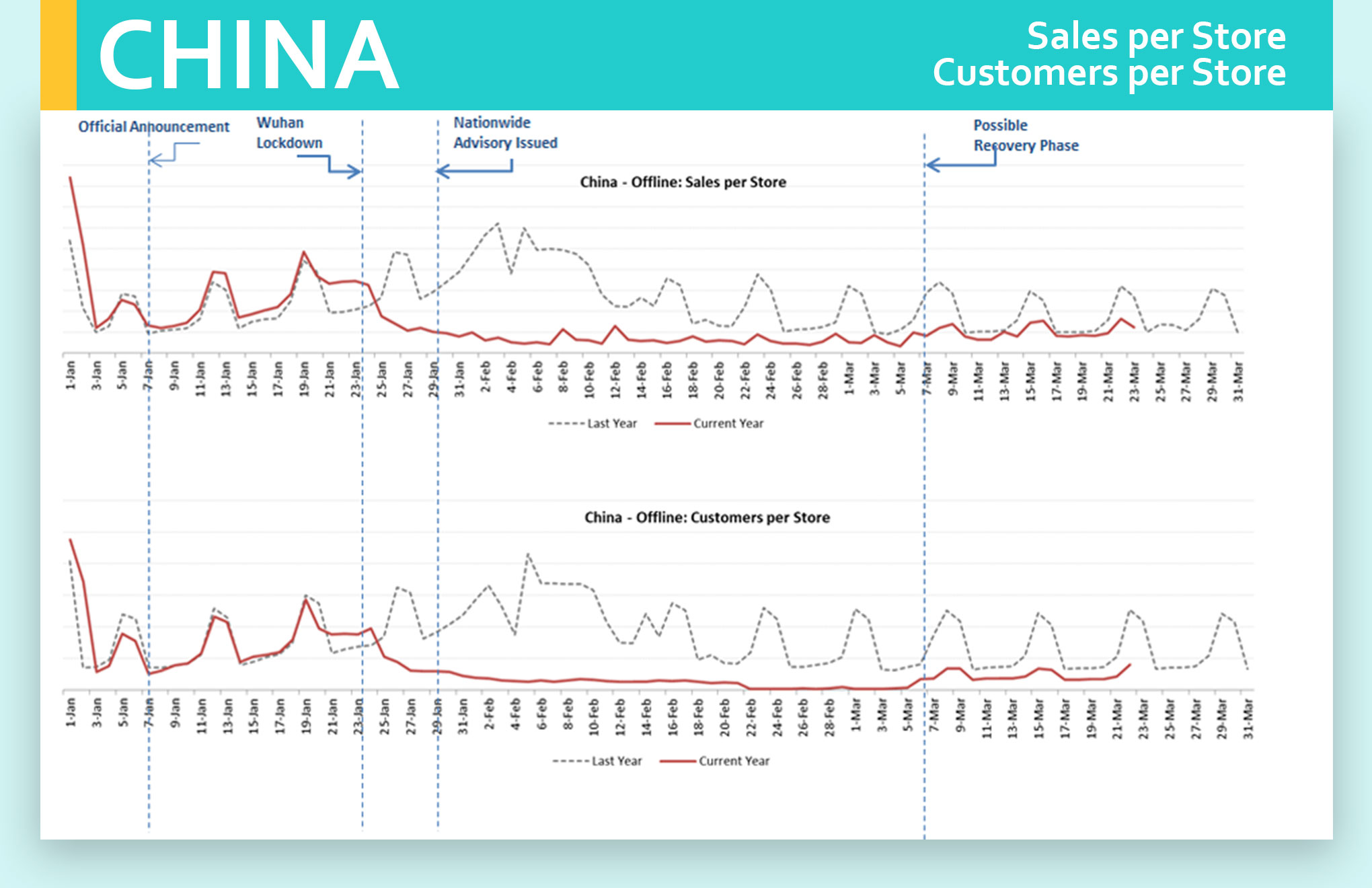

Finding 1: Over 65% Drop in Average Sales per Store and a 79% decrease in Customers per Store

Finding 2: There was an increase in retail sales starting from March 6th,2020

After just 8 weeks since the initial lockdown, the retail market in China appears to be in the early stages of recovery. This is indicated by the surge in two key metrics: Sales Per Store & Customers Per Store in the past few weeks.

Pre-lockdown : 1st Dec 2019 to 25th Jan 2020

Lockdown Period: 26th Jan 2020 to 5th March 2020

Probable Recovery Period: 6th March Onwards

Compared to the lockdown period, in the “Probable Recovery Period”-starting from March 6th (we are calling it PRP as we see a surge in related metrics, need to see if this is sustained) retailers witnessed 22% increase in sales and 43% increase in customers.

*Update as of 19th May 2020

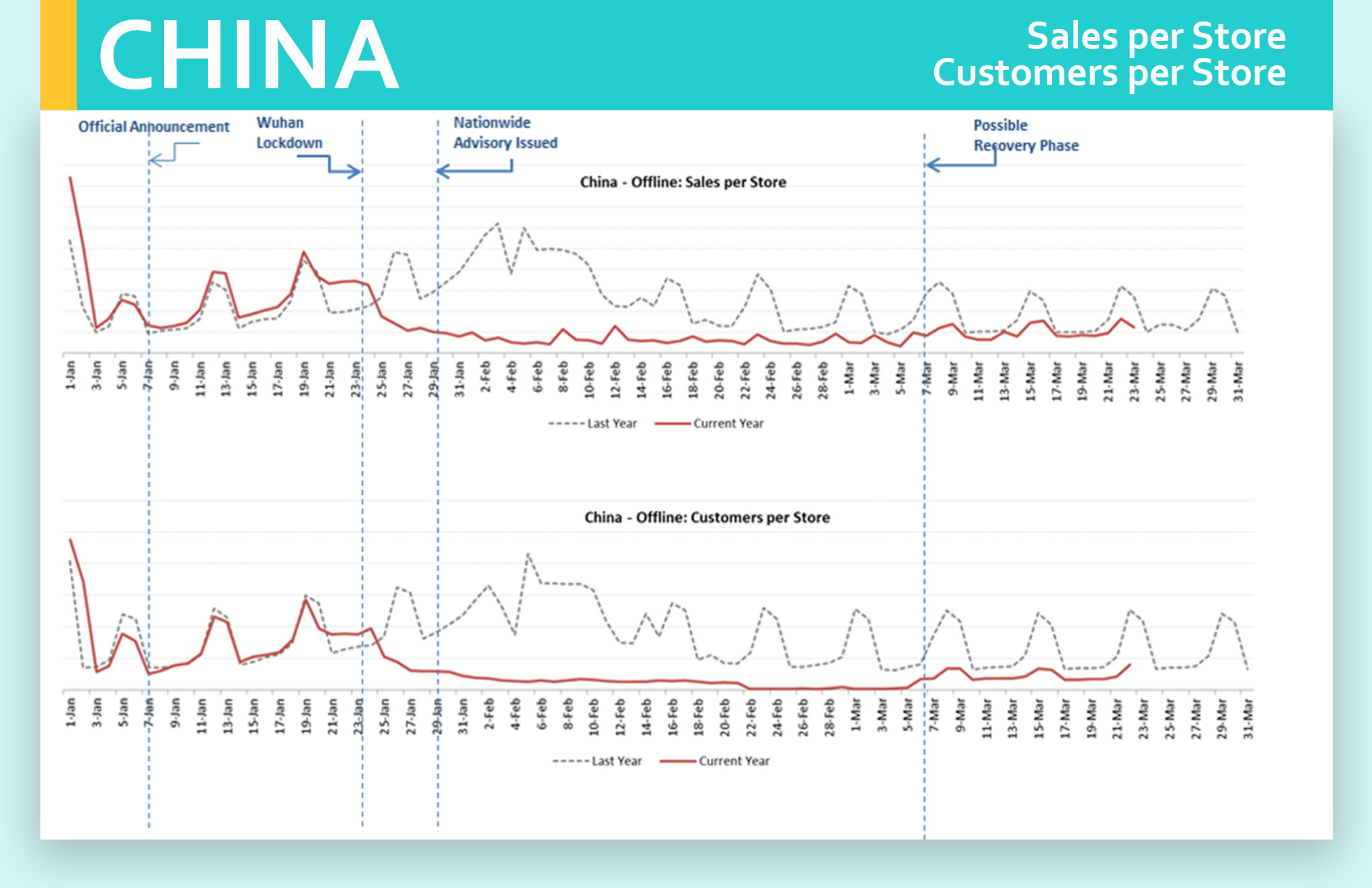

Finding 3: Store footfalls have reached 65-70% of base levels (1st week of January) starting from the first week of May

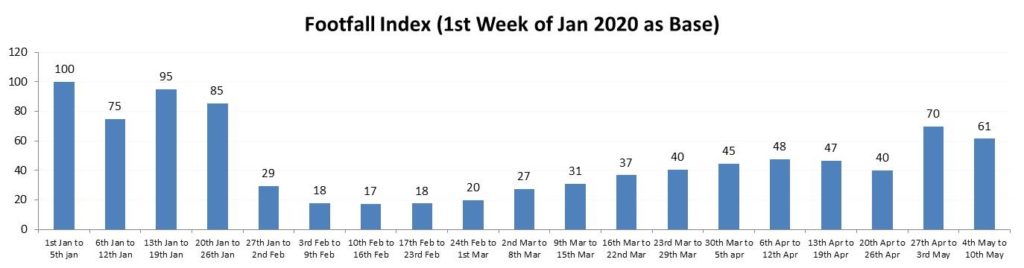

Finding 4: Sales per store which took a big hit during the lockdown is slowly coming back to similar levels as last year

Key Insight

- We are seeing an uptick in sales and customers after 6th March 2020. If we consider this date as a cutoff period, it has taken around 1.5 months for recovery to start after the Wuhan Lockdown (25th Jan to 5th March).

- It took around 3 months for sales and store footfalls to reach pre-COVID levels in China.

Covid-19’s Impact on Singapore Retail

Expected Recovery Period: Ongoing

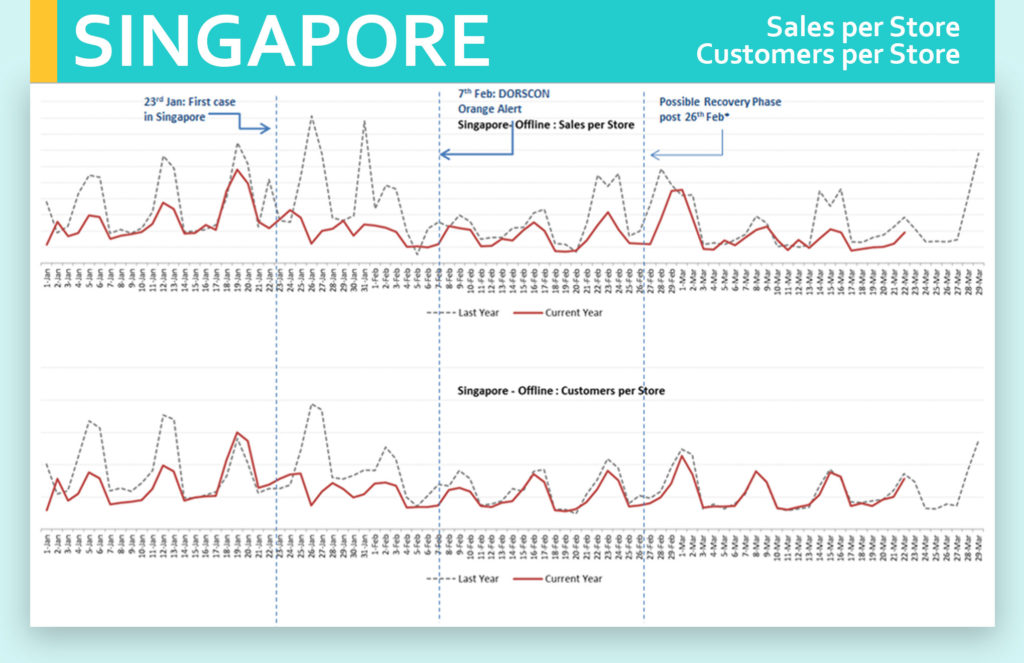

*Timeline Reference :

Prior to Dorscon Orange Alert : From Jan 1st-Jan 23rd,2020

Post Dorscon Orange Alert : From Jan 24th-27th Feb,2020

Probable Recovery Period : Ongoing

Singapore witnessed a perceptible drop in retail sales but not as significant as that of China. A possible reason could be that Singapore has managed to contain the infection fairly well and avoided a lockdown. Our analysis of sales and customers per store data of 10 leading brands across 1000 stores also reiterates the positive outlook for the Singapore retail market.

The Findings

- Prior to Dorscon Orange Alert: From Jan 1st-Jan 23rd,2020 sales per store was 18% lower and the number of customers per store was 8.5% lower compared to the same time period in 2019

- Since Dorscon Orange Alert: From Jan 24th-27th Feb,2020 sales slumped by 45% and the number of customers per store was 26% lower compared to the same time period last year.

- Currently: From 28th Feb to 1st March, we saw a sudden surge in sales and customers per store. Post 1st march,2020, we are observing 34% decline in sales per store compared to the previous year (compared to 45% drop during Orange Alert), and 10% decline in the number of customers per store(compared to 26% drop during Orange Alert)

Key Insight

- We have been getting reports of the retail market being back to normal (even though tourism is severely impacted), with footfall in malls is now 95% of what it was before.

- Although the number of customers per store has increased post the Orange Alert, we have not noticed a significant jump in sales indicating customer reluctance in spending

*Update on 6th April 2020

- With the impending lockdown, the recovery period is predicted to be delayed further, at least until the end of May/Mid-June.

Business Recovery Prediction for Singapore

The retail sales recovery period for Singapore seems to have started and expected to be ongoing. However, with the ever-increasing restrictions imposed on the movement of people in malls and restaurants, the recovery trends may be inconsistent and could deviate till the end of April.

*Update on 6th April 2020

- The business recovery prediction in Singapore is expected to be delayed until the end of May/Mid-June due to the recent announcement of the nation-wide lockdown indicate, however, we foresee a faster recovery period of 1 -1.5 months in Singapore compared to the 2.5 months in China.

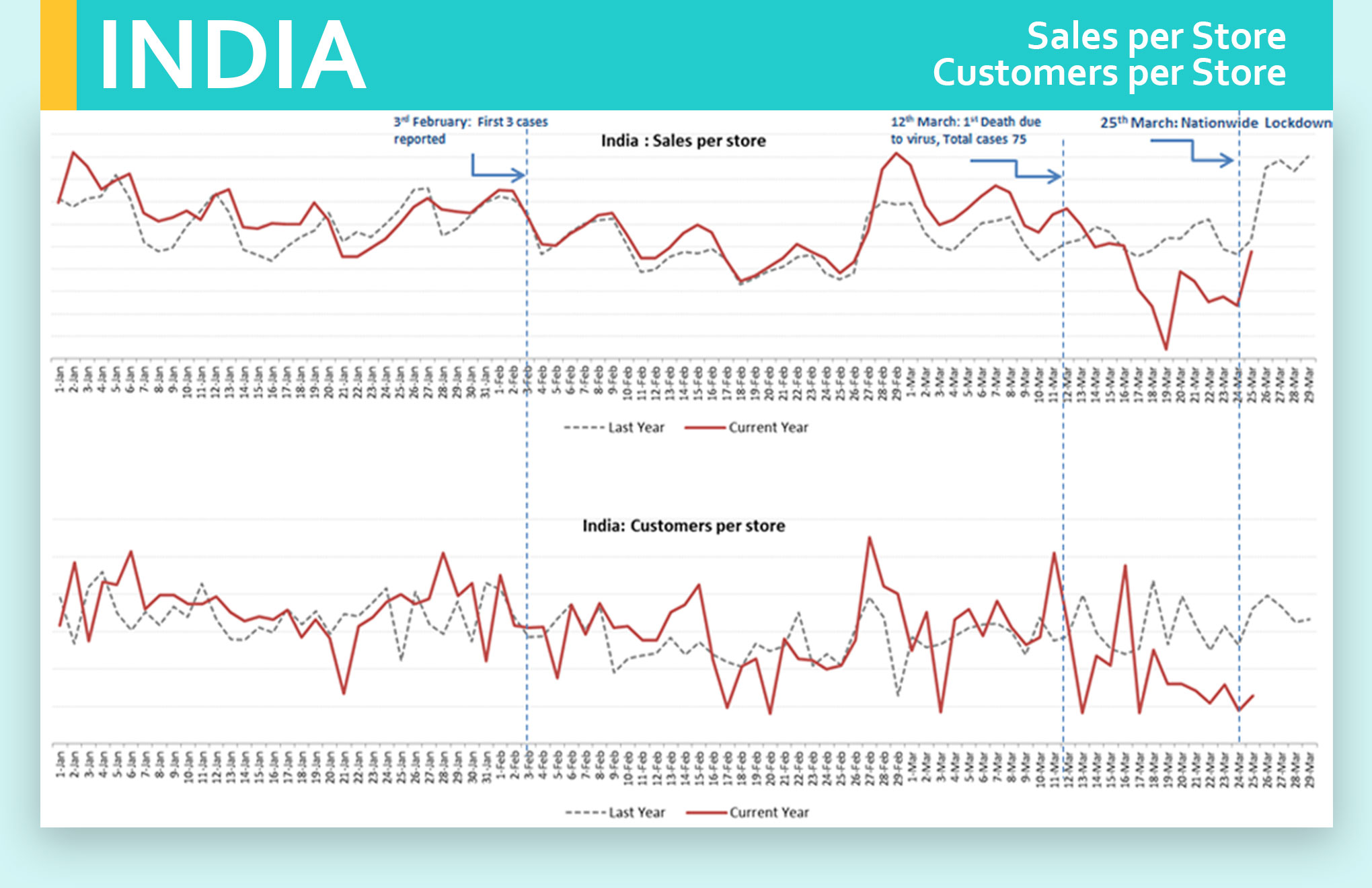

Covid-19’s Impact on India Retail

Expected Recovery Period: First Week of May

*Timeline Reference :

Prior to lockdown: From Jan 1st-March 25th,2020

Lockdown Period:Ongoing

Probable Recovery Period:1st week of May

India seems to have entered Stage 3 of the Covid-19 outbreak, however, the government has stepped up its effort and is leaving no stone unturned in fighting the epidemic. The epidemic broke out when the Indian economy was already reeling under a slowdown in consumption for everything from cars to confectionaries.

Lifestyle and fashion retailers are likely to be impacted most due to the restrictions and lockdowns, resulting in demand squeeze in the short-term. However, we expect the combination of young demographics, rising disposable income and the positive headroom growth for organised retail to mitigate many of these challenges in the long term.

Finding 1

- Until 16th March, the consumer retail sales and walk-ins did not see many dips compared to last year, this could be due to festive shopping (Ugadi, Gudi Padwa, Navratri etc).

- However, the India consumer retail witnessed a big drop in sales by 46% and 55% fall in the number of customers per store from 17th to 25th March, which is expected to drop further in the coming weeks due to the ongoing nation-wide lockdown.

*Update as of 19th May 2020

Finding 2: Multi-brand Supermarkets witnessed ~70% drop in YoY sales

Finding 3: Single Brand Apparel Outlets have witnessed a spike in sales from 1st week of May

Business Recovery Prediction for India

Considering the ongoing recovery trends observed across China and Singapore, and provided that there is no further extension on the lockdown, the retail sales recovery period for India might kickstart from the first week of May.

Covid-19’s Impact on Middle East Retail

Expected Recovery Period: Third Week of May

*Timeline Reference :

Prior to lockdown: From Jan 1st – March 25th,2020

Lockdown Period: Ongoing

Probable Recovery Period: 3rd week of May

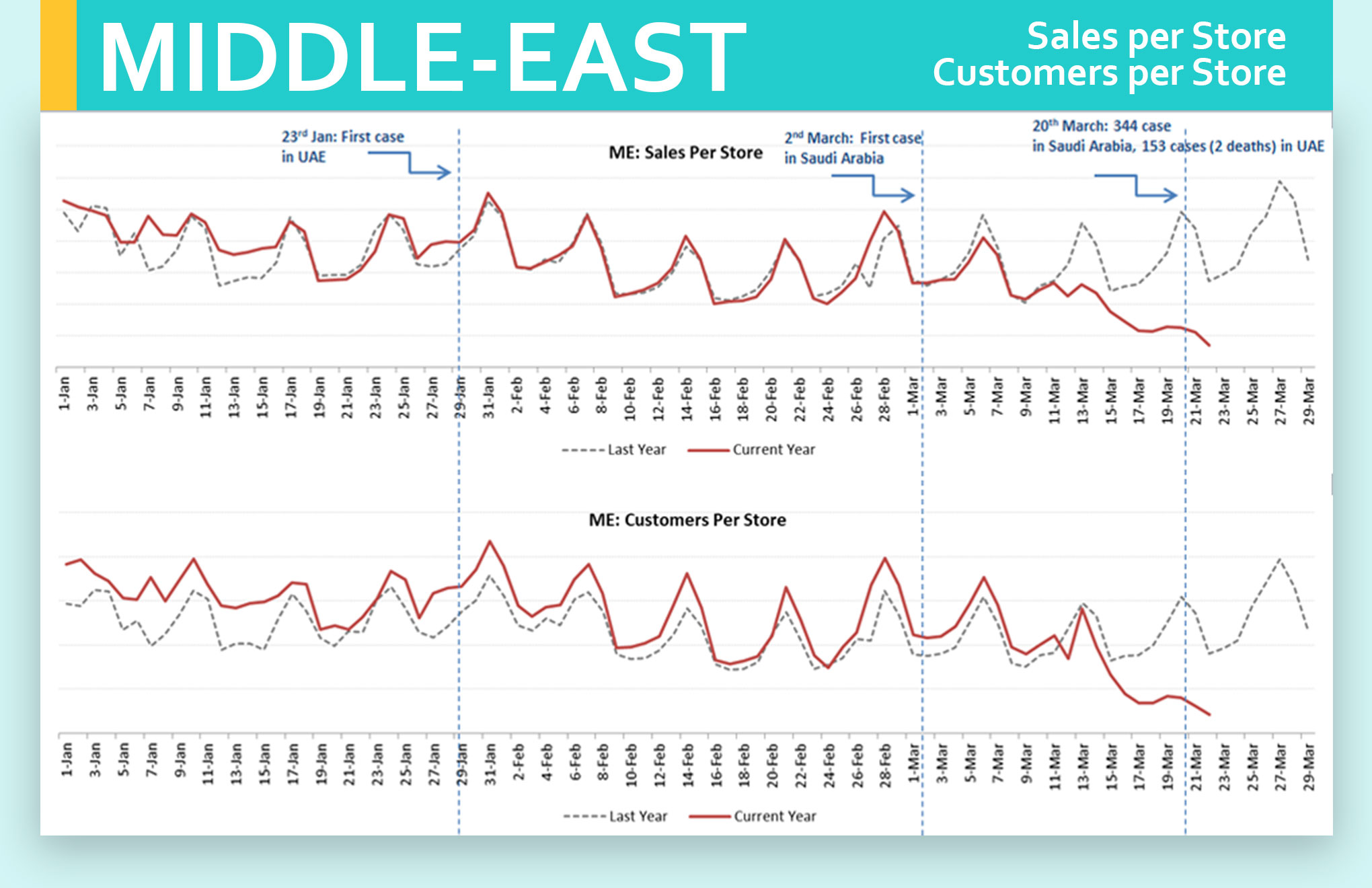

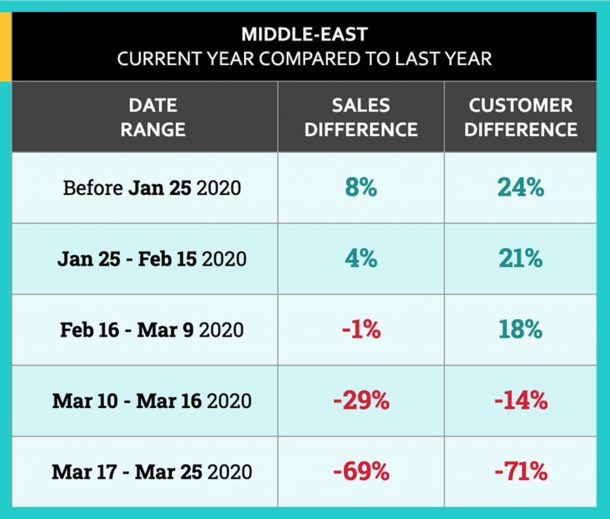

The first case of coronavirus in the Middle East was reported on January 23rd in the UAE. Since then, the outbreak has spread to Saudi Arabia, Iran, Syria, and Iraq, with Iran being the worst hit. The epidemic is expected to have a severe impact on the region’s retail market since tourists, especially Chinese shoppers, account for a significant chunk of sales to the Middle East’s luxury goods market. Governments in the Middle East have put in place a series of measures to contain the highly contagious outbreak with several nations going into indefinite lockdown mode.

Finding 1

Our data shows a steep decline in sales and customers per store post-March 15th, which is expected to deepen after UAE’s announcement of lockdown on malls and stores.

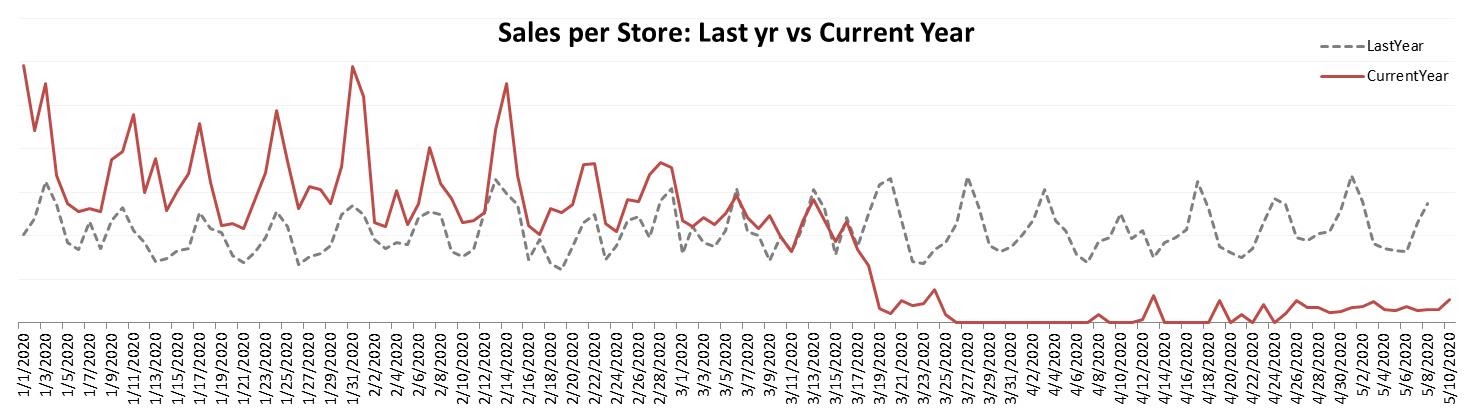

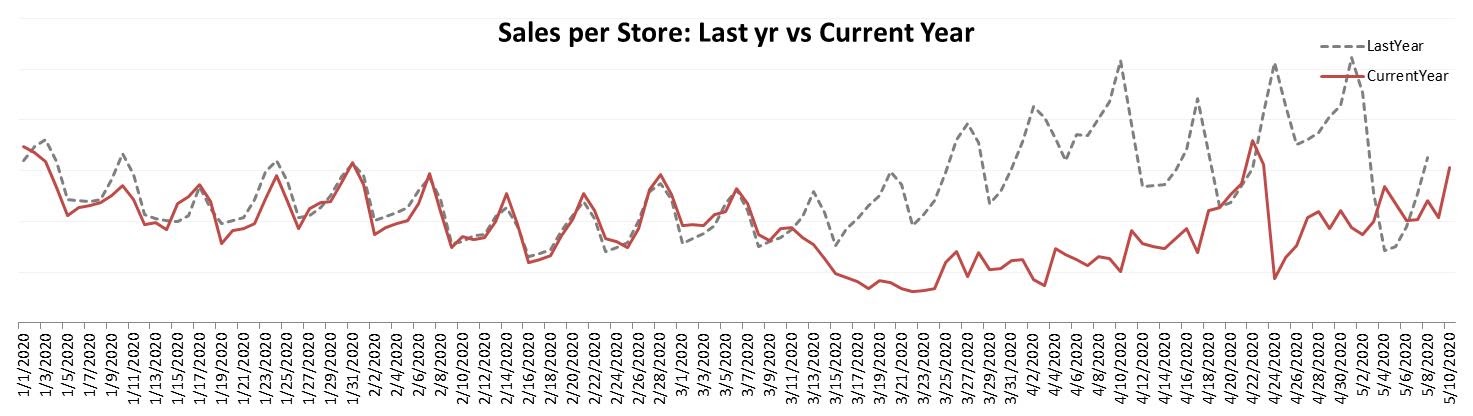

*Update as of 19th May 2020

Finding 2: The luxury retail sector is badly hit with sales dropping by 90% compared to last year

Finding 3: There has been an uptick in Apparel sales from the first week of May

Business Recovery Prediction for the Middle East

Although the governments continue to impose lockdown, trends and experts indicate that retailers in the Middle East may start observing an uptick in their retail sales from the third week of May 2020 provided there are no further lockdowns imposed by the end of April.

Key recommendations for Retailers on Charting their Road to Recovery

Let’s admit it, the short term impact of COVID-19 on retailers will be severe. Few Offline retailers may have to temporarily or permanently shut down stores, few may face cash flow challenges, almost all of them may have to cut costs and reduce overheads. Even online businesses are likely to face delivery restrictions, delays and supply chain disruptions during this time. From our findings, below are a few takeaways on how retailers can tackle this crisis.

-

Being Omnichannel = Being resilient

From our findings, the most resilient retailers surviving this epidemic are the omnichannel retailers. Brands who invested in enabling a personalized omnichannel shopping experience are experiencing the fruits of their labour. For instance, Chinese apparel brands like Peacebird, Gloria and Youngor who had started their omnichannel digital transformation journeys (through the integration of online and offline channels) experienced a consistent increase in their online sales despite the uncertain in-store sales.

-

Live commerce as an emerging trend

China has become the epi-centre for live stream commerce. Chinese e-commerce platforms Taobao and JD.com are leading the live commerce world by enabling the live stream viewers to purchase items while they watch. Live commerce as they term it, has become an emerging trend to bank upon amidst the COVID-19 sales slump.

-

Merging the offline and the online data to upgrade online selling

At a company level, offline teams should coordinate with the online team to divert the traffic to their ecommerce website/app and clear out the inventory. Brands can also improve the quality of customer engagement across relevant channels by merging store behaviour data with CRM data to communicate and notify its customers about store operating hours, delivery timelines or to send any form of notifications. Integrating data across online, social and offline channels can improve the micro-segmentation of customers and enhance the relevance of personalised communication.

The Covid-19 epidemic is a crisis unlike anything we have faced in the recent past. We are still on the tip of the iceberg when it comes to uncovering the impact of the coronavirus. However, as the events unfold, retailers should be prepared to accelerate their omnichannel engagement and technology initiatives. Until then, stay indoors, practice social distancing and do your part to stop the spread of COVID-19.

People also ask ⁝

1.What are effective business recovery strategies for companies in China?

Effective strategies include diversifying supply chains, leveraging digital technologies, and focusing on customer-centric approaches to regain market position.

2.How can digital transformation aid in business recovery in China?

Digital transformation enables businesses to streamline operations, enhance customer engagement, and adapt to changing market dynamics, aiding in recovery efforts.

3.What role does government support play in business recovery in China?

Government support, such as financial incentives and policy reforms, can provide critical assistance to businesses looking to recover and grow in the Chinese market.

4.How can businesses in China adapt to post-pandemic market conditions?

Businesses can adapt by embracing digital solutions, reassessing their supply chains, and prioritizing customer needs and preferences in the new normal.

5.What are the key challenges in implementing recovery strategies in China?

Key challenges include navigating regulatory changes, managing supply chain disruptions, and maintaining customer trust and loyalty during the recovery phase.