“I want us to stop talking about digital and physical retail as if they’re two separate things. The customer doesn’t think of it that way, and we can’t either,”– Doug McMillon, CEO Walmart. This quote clearly sums up the way ahead for omnichannel retail in India. Omnichannel has been the buzzword in the Indian retail world for quite some time now but omnichannel remains largely uncomprehended or misunderstood by the retail industry in India.

The bigger question remains if it’s the right time for the Indian retailers and consumer goods companies to adopt omnichannel strategies and implement them on a large scale to see their ROI results unfold?

Let us explore some facets about omnichannel retailing and the factors that can majorly impact the omnichannel retail trends in India.

Omnichannel Retail can mean many of the following things:-

Retailers would first need to first prioritize and address the categories that majorly affect their ROI, volume of transactions and the repeat purchase potential before implementing specific omnichannel retail strategies. For example, brands such as Big Bazaar and Landmark group that have major in-store presence compared to an online presence can prioritize their marketing and merchandising needs over their customer service needs in their overall omnichannel retail strategy road-map. Contrarily, major marketplace brands would need to first focus on their fulfillment, customer service and marketing needs before diverging into other areas in their omnichannel strategy road map.

The present retail landscape in India

It is a well-known fact that India is the world’s second largest consumer market and Indian retail industry is rapidly modernizing. According to multiple sources, India’s retail industry is expected to grow from $600 billion in 2015 to $1 trillion by 2020.

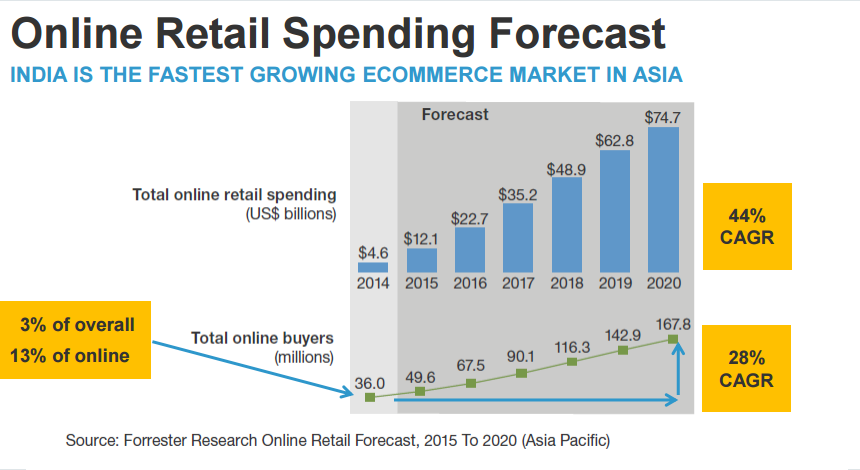

The digital channels are growing its roots in India at an unprecedented pace. India is the fastest growing e-commerce market in Asia with a CAGR of 44% compared to the overall average CAGR of 28%.

As far as online and smartphone adoption is concerned according to Forrester’s Asia Pacific Online Retail Forecast, 2014 to 2019, India will have 125 million online buyers by the end of 2019. Forrester expects mobile to overtake PCs in 2016 in terms of sales and reach $19 billion by 2019. Furthermore, in India we can expect the web to influence $70Bn of retail sales in 2019 which accounts for 30% of the overall organized retail market in India.

Some of the key factors driving the retail growth in India include the impact on the overall ROI and operating margins for the retailers, the need to drive the number of transactions/customer, the need to provide superior customer engagement, superior customer experience and the need to drive an integrated view of the customer data across both online and offline channels.

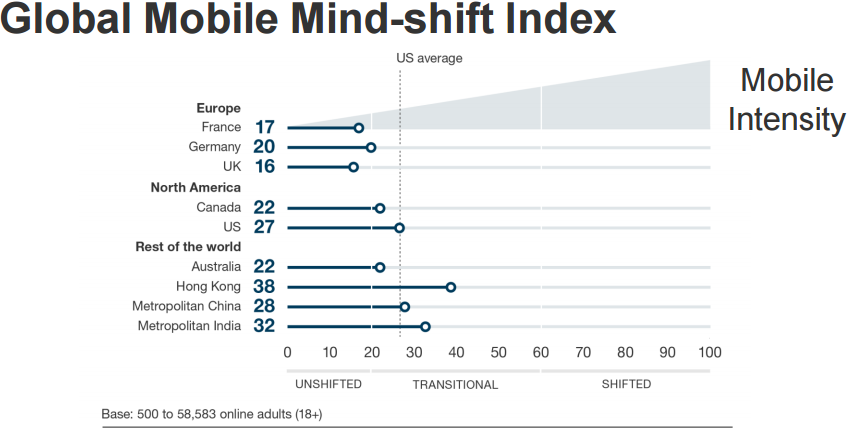

With over 50 million online shoppers in 2015 and with an above average mobile intensity score of 32(on a scale of 100), Indian consumers are definitely redefining what it means to shop in today’s information-driven environment.

Who are the Drivers of Omnichannel Retail in India?

Target Market Point of View

According to various sources, the online sales in India is expected to reach $70Bn by 2019 which would account for nearly 30% of the organized retail sales in India. Majority of these online buyers (nearly 39%) belong to the 25-34 age group as stated by a Forrester report on the composition of the online audience across Asia Pacific. The report also revealed that 37% of the online audience across Asia Pacific were in the age group between 15-24. This data clearly indicates the need for Indian retailers to target the Gen Y and the millennials to drive their online store sales.

The Indian Consumer Behavior is digitally evolving

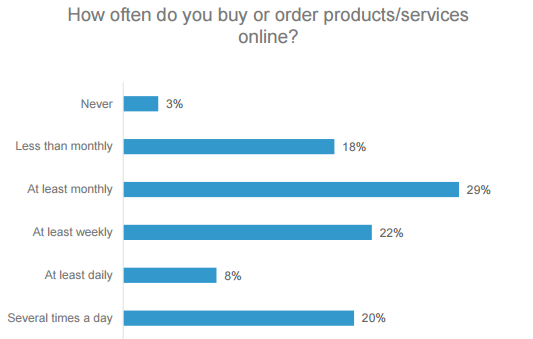

The consumer behavior landscape in India is also changing dramatically. According to Forrester Research’s Indian Consumer Techno graphics Survey 2016, nearly 29% of the surveyed retail consumers stated that they buy or order product/services online at least once a month and nearly 22% of the surveyed consumers buy products on a weekly basis. Implementing an omnichannel retail strategy seems like the step in the right direction for Indian retailers to leverage this major psychological shift in mindset of an Indian consumer.

Source: Forrester Research Consumer Techno graphics Survey 2016

Are we addressing webrooming, showrooming and the Marketplace v/s single brand eCommerce concerns?

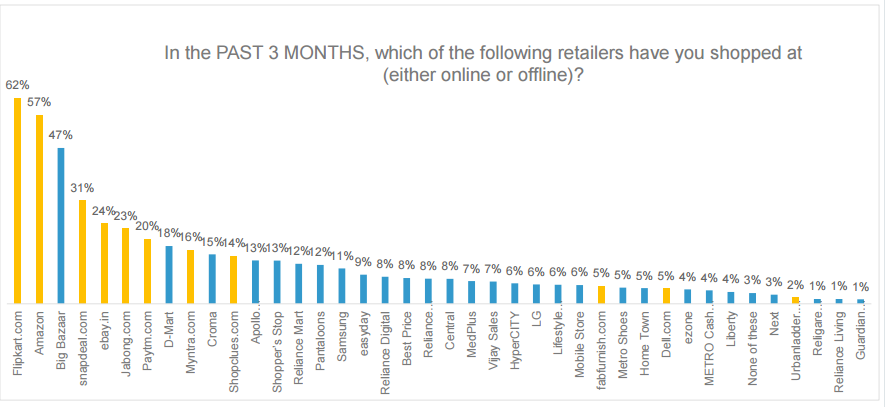

Retailers have started to track popular marketplace vs single brand retailing trends to make critical decisions about adopting the right mix omnichannel retail strategies for their brands.

They are also aware of the impact of prevailing showrooming and web rooming trends in order to not lose out on their in-store or online sales due to pricing or customer experiences issues.

Source: Forrester Research Consumer Techno graphics Survey

Well, I know we have discussed about several aspects on the state of omnichannel retail in India. But I am not done yet. In the next set of sections, I would reflect upon the technology challenges and about the different payment trends in India.

Learn more interesting facts and insights on “The state of omnichannel retail in India in 2016” by downloading our info-graphic. Click on the link to access the info-graphic : http://bit.ly/2fjB4Qp